Page 32 - impiantistica_3_2015

P. 32

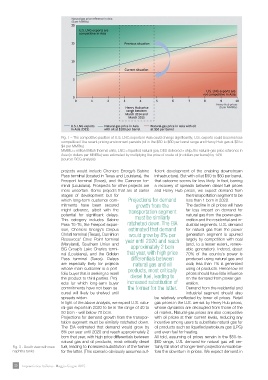

Fig. 1 – The competitive position of U.S. LNG exports in Asia could change significantly; U.S. exports could become less

competitive if the recent pricing environment persists (oil in the $50 to $60 per barrel range and Henry Hub gas at $3 to

$4 per MMBtu)

MMBtu = million British thermal units; LNG = liquefied natural gas; DES delivered × ship; the natural-gas price reference in

Asia (in dollars per MMBtu) was estimated by multiplying the price of crude oil (in dollars per barrel) by 14%

(source: BCG analysis)

projects would include Cheniere Energy’s Sabine ficient development of the enabling downstream

Pass terminal (located in Texas and Louisiana), the infrastructure). But with oil at $50 to $60 per barrel,

Freeport terminal (Texas), and the Cameron ter- that outcome seems far less likely. In fact, barring

minal (Louisiana). Prospects for other projects are a recovery of spreads between diesel fuel prices

more uncertain. Some projects that are at earlier and Henry Hub prices, we expect demand from

stages of development but for Projections for demand the transportation segment to be

which long-term customer com- growth from the less than 1 bcm in 2020.

mitments have been secured The decline in oil prices will have

might advance, albeit with the transportation segment far less impact on demand for

potential for significant delays. must be similarly natural gas from the power-gen-

This category includes Sabine eration and the residential and in-

Pass T5-T6, the Freeport expan- ratcheted down. The EIA dustrial segments. U.S. demand

sion, Cheniere Energy’s Corpus estimated that demand for natural gas from the power

would grow by 8% per

Christi terminal (Texas), Dominion year until 2020 and reach generation segment is spurred

Resources’ Cove Point terminal largely by competition with coal

(Maryland), Southern Union and approximately 2 bcm (and, to a lesser extent, renew-

BG Group’s Lake Charles termi- that year, with high price able generation). Indeed, about

nal (Louisiana), and the Golden 70% of the country’s power is

Pass terminal (Texas). Delays differentials between produced using natural gas and

are especially likely for projects natural gas and oil coal; less than 1% is generated

whose main customer is a port- products, most critically using oil products. Hence low oil

folio buyer that is seeking to resell diesel fuel, leading to prices should have little influence

the product to third parties. Proj- increased substitution of on the demand from power gen-

ects for which long-term buyer the former for the latter. eration.

commitments have not been se- Demand from the residential and

cured will likely be shelved until industrial segment should also

spreads widen. be relatively unaffected by lower oil prices. Retail

In light of the above analysis, we expect U.S. natu- gas prices in the U.S. are set by Henry Hub prices,

ral-gas exports in 2020 to be in the range of 40 to whose dynamics are decoupled from those of the

50 bcm - well below 70 bcm. oil market. Natural-gas prices are also competitive

Projections for demand growth from the transpor- with oil prices at their current levels, reducing any

tation segment must be similarly ratcheted down. incentive among users to substitute natural gas for

The EIA estimated that demand would grow by oil products such as liquefied petroleum gas (LPG)

8% per year until 2020 and reach approximately 2 and even fuel for heating.

bcm that year, with high price differentials between All told, assuming oil prices remain in the $50-to-

natural gas and oil products, most critically diesel $60 range, U.S. demand for natural gas will cer-

Fig. 3 - South view with new fuel, leading to increased substitution of the former tainly fall short of longer-term projections made be-

naphtha tanks

for the latter. (This scenario obviously assumes suf- fore the downturn in prices. We expect demand in

30 Impiantistica Italiana - Maggio-Giugno 2015