Page 78 - Impiantistica Industriale - Settembre Ottobre 2014

P. 78

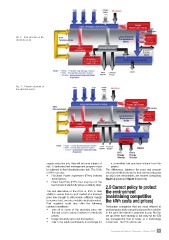

. 2 - Past structure of the

electricity sector

Fig. 3 - Present structure of

the electricity sector

supply and price risk, they will be more subject at a committed fuel purchase volume from the

risk. A dedicated fuel management program must project.

be planned to limit electricity price risk. The IOUs The differences between the past and present

or IPPs can use: structure of electricity sector, that are becoming day

• Purchase Power Agreement (PPAs) indexed by day more remarkable, are evident comparing

figure 2 (past) and figure 3 (present).

to fuel prices;

• Fixed Fuel Price (FFP), that may be not the 2.0 Correct policy to protect

the environment

best choice if electricity prices suddenly drop. (maintaining competitive

the kWh costs and prices)

The real alternative of the IOUs or IPPs is their

ability to secure fuel on spot market at a forecast Production companies that are most efficient at

price low enough to still provide sufficient margin producing electricity can get better profits in relation

to service debt, even in a volatile electricity market. to the price the market is prepared to pay. But the

Fuel suppliers could also offer the following set up of the best strategy is not easy for the ESI

contract conditions: top management that is today at a technology

• take all or some of the electricity price risk crossroads. The ESI options are:

through a fuel contract indexed to electricity

prices;

• hedge electricity price risk themselves;

• offer to be equity participants in exchange for

Impiantistica Italiana - Settembre - Ottobre 2014 77

electricity sector

Fig. 3 - Present structure of

the electricity sector

supply and price risk, they will be more subject at a committed fuel purchase volume from the

risk. A dedicated fuel management program must project.

be planned to limit electricity price risk. The IOUs The differences between the past and present

or IPPs can use: structure of electricity sector, that are becoming day

• Purchase Power Agreement (PPAs) indexed by day more remarkable, are evident comparing

figure 2 (past) and figure 3 (present).

to fuel prices;

• Fixed Fuel Price (FFP), that may be not the 2.0 Correct policy to protect

the environment

best choice if electricity prices suddenly drop. (maintaining competitive

the kWh costs and prices)

The real alternative of the IOUs or IPPs is their

ability to secure fuel on spot market at a forecast Production companies that are most efficient at

price low enough to still provide sufficient margin producing electricity can get better profits in relation

to service debt, even in a volatile electricity market. to the price the market is prepared to pay. But the

Fuel suppliers could also offer the following set up of the best strategy is not easy for the ESI

contract conditions: top management that is today at a technology

• take all or some of the electricity price risk crossroads. The ESI options are:

through a fuel contract indexed to electricity

prices;

• hedge electricity price risk themselves;

• offer to be equity participants in exchange for

Impiantistica Italiana - Settembre - Ottobre 2014 77