Page 30 - 38

P. 30

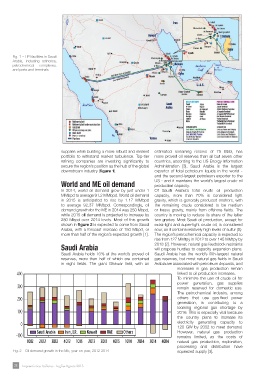

Fig. 1 – HPI facilities in Saudi

Arabia, including refineries,

petrochemical complexes,

and ports and terminals

supplies while building a more robust and resilient estimated remaining reserve of 75 Bbbl, has

portfolio to withstand market turbulence. Top-tier more proved oil reserves than all but seven other

refining companies are investing significantly to countries, according to the US Energy Information

secure the region’s position as the hub of the global Administration [3]. Saudi Arabia is the largest

downstream industry (figure 1). exporter of total petroleum liquids in the world -

and the second-largest petroleum exporter to the

World and ME oil demand US - and it maintains the world’s largest crude oil

production capacity.

In 2014, world oil demand grew by just under 1 Of Saudi Arabia’s total crude oil production

MMbpd to average 91.2 MMbpd. World oil demand capacity, more than 70% is considered light

in 2015 is anticipated to rise by 1.17 MMbpd gravity, which is generally produced onshore, with

to average 92.37 MMbpd. Correspondingly, oil the remaining crude considered to be medium

demand growth for the ME in 2014 was 250 Mbpd, or heavy gravity, mainly from offshore fields. The

while 2015 oil demand is projected to increase by country is moving to reduce its share of the latter

280 Mbpd over 2014 levels. Most of this growth two grades. Most Saudi oil production, except for

shown in figure 2 is expected to come from Saudi extra-light and super-light crude oil, is considered

Arabia, with a forecast increase of 150 Mbpd, or sour, as it contains relatively high levels of sulfur (S).

more than half of the region’s expected growth [1]. The region’s petrochemical capacity is expected to

rise from 127 MMtpy in 2012 to over 145 MMtpy by

Saudi Arabia 2018 [2]. However, natural gas feedstock restraints

will propose hurdles to capacity expansion plans.

Saudi Arabia holds 16% of the world’s proved oil Saudi Arabia has the world’s fifth-largest natural

reserves, more than half of which are contained gas reserves, but most natural gas fields in Saudi

in eight fields. The giant Ghawar field, with an Arabia are associated with petroleum deposits, and

Fig. 2 – Oil demand growth in the ME, year-on-year, 2012-2014 increases in gas production remain

linked to oil production increases.

To minimize the use of crude oil for

power generation, gas supplies

remain reserved for domestic use.

The petrochemical industry, among

others that use gas-fired power

generation, is contributing to a

looming regional gas shortage by

2016. This is especially vital because

the country plans to increase its

electricity generating capacity to

120 GW by 2032 to meet demand.

However, natural gas production

remains limited, as the costs of

natural gas production, exploration,

processing and distribution have

squeezed supply [3].

28 Impiantistica Italiana - Luglio-Agosto 2015