Page 24 - 51

P. 24

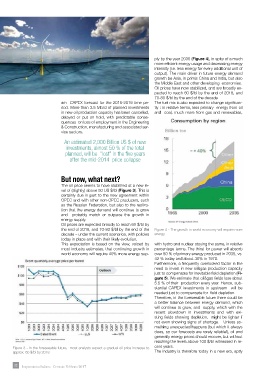

ply by the year 2035 (Figure 4), in spite of a much

more efficient energy usage and decreasing energy

intensity (i.e. less energy for every additional unit of

output). The main driver in future energy demand

growth be Asia, in primis China and India, but also

the Middle East and other developing economies.

Oil prices have now stabilized, and are broadly ex-

pected to reach 60 $/bl by the end of 2018, and

70-80 $/bl by the end of the decade

am CAPEX forecast for the 2015-2019 time pe- The fuel mix is also expected to change significan-

riod. More than 3.5 Mb/d of planned investments tly : in relative terms, less primary energy from oil

in new oil production capacity has been cancelled, and coal, much more from gas and renewables,

delayed or put on hold, with predictable conse-

quences on loss of employment in the Engineering

& Construction, manufacturing and associated ser-

vice sectors.

An estimated 2,000 Billion US $ of new

investments, almost 50 % of the total

planned, will be “lost” in the five years

after the mid-2014 price collapse

But now, what next?

The oil price seems to have stabilized at a new le-

vel of (slightly) above 50 US $/bl (Figure 3). This is

certainly due in part to the new agreement within

OPEC and with other non-OPEC producers, such

as the Russian Federation, but also to the realiza-

tion that the energy demand will continue to grow

and probably match or outpace the growth in

energy supply.

Oil prices are expected broadly to reach 60 $/bl by

the end of 2018, and 70-80 $/bl by the end of the Figure 4 - The growth in world economy will require more

decade – under the current scenarios, with policies energy

today in place and with their likely evolution.

This expectation is based on the view, voiced by with hydro and nuclear staying the same, in relative

most industry estimates, that continuing growth in percentage terms. The thirst for power will absorb

world economy will require 40% more energy sup- over 50 % of primary energy produced in 2035, vs.

42 % today and about 30% in 1970.

Furthermore, a frequently overlooked factor is the

need to invest in new oil&gas production capacity

just to compensate for inevitable field depletion (Fi-

gure 5). We estimate that oil&gas fields lose about

5.5 % of their production every year. Hence, sub-

stantial CAPEX investments in upstream will be

needed just to compensate for field depletion.

Therefore, in the foreseeable future there could be

a better balance between energy demand, which

will continue to grow, and supply, which with the

recent slowdown in investments and with exi-

sting fields showing depletion, might be tighter if

not even showing signs of shortage. Unless so-

mething unexpected happens (but which it always

does, so our forecasts are rarely reliable!), oil and

generally energy prices should recover, but without

reaching the levels above 100 $/bl witnessed in re-

Figure 3 - In the foreseeable future, most analysts expect a gradual oil price increase to cent years.

approx. 60 $/bl by 2018 The industry is therefore today in a new era, aptly

22 Impiantistica Italiana - Gennaio-Febbraio 2017