Page 23 - 60

P. 23

are on the drawing board, awaiting FIDs over the

next few years, in order to come on stream in mid-

2020s. We expect the current oversupply to be ab-

sorbed without major difficulties.

Asia, particularly China and India, remains the key

market for future LNG growth, with increasing de-

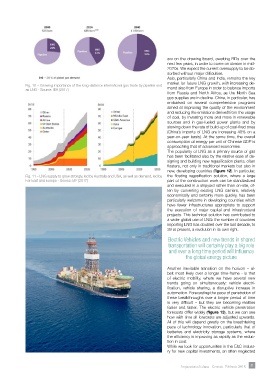

Fig. 10 – Growing importance of the long-distance international gas trade by pipeline and mand also from Europe in order to balance imports

as LNG - Source: IEA (2017)

from Russia and North Africa, as the North Sea

gas supplies are in decline. China, in particular, has

embarked on several comprehensive programs

aimed at improving the quality of the environment

and reducing the emissions derived from the usage

of coal, by investing more and more in renewable

sources and in gas-fueled power plants and by

slowing down the rate of build-up of coal-fired ones

(China’s imports of LNG are increasing 40% on a

year-on-year basis). At the same time, the overall

consumption of energy per unit of Chinese GDP is

approaching that of advanced economies.

The popularity of LNG as a primary source of gas

has been facilitated also by the relative ease of de-

signing and building new regasification plants, often

floaters, not only in traditional markets but also in

new, developing countries (figure 12). In particular,

Fig. 11 – LNG supply to grow strongly, led by Australia and USA, as well as demand, led by the floating regasification solution, where a large

Far East and Europe - Source: BP (2017) part of the construction work can be standardized

and executed in a shipyard rather than on-site, of-

ten by converting existing LNG carriers, relatively

economically and certainly more quickly, has been

particularly welcome in developing countries which

have fewer infrastructures appropriate to support

the execution of major capital and infrastructural

projects. This technical solution has contributed to

a wider global use of LNG: the number of countries

importing LNG has doubled over the last decade, to

39 at present, a revolution in its own right.

Electric Vehicles and new trends in shared

transportation will certainly play a big role

and over a long time period will influence

the global energy picture

Another inevitable transition on the horizon – al-

beit most likely over a longer time-frame - is that

of electric mobility, where we have several new

trends going on simultaneously: vehicle electri-

fication, vehicle sharing, a disruptive increase in

automation. Forecasting the pace of penetration of

these breakthroughs over a longer period of time

is very difficult – but they are becoming realities

faster and faster. The electric vehicle penetration

forecasts differ widely (figure 13), but we can see

how with time all forecasts are adjusted upwards.

All of this will depend greatly on the breathtaking

pace of technology innovation, particularly that of

batteries and electricity storage systems, where

the efficiency is improving as rapidly as the reduc-

tion in cost.

While we look for opportunities in the E&C indust-

ry for new capital investments, an often neglected

Impiantistica Italiana - Gennaio- Febbraio 2018 21