Page 32 - 51

P. 32

Refining and Marketing), thus divesting non-core

assets. Eni has set a divestment target of $7bn

between 2016 and 2019, while Shell launched a

large asset sale program consisting in $30bn as-

sets sales mainly in the North Sea and other exam-

ples can be made for most IOCs. This trend is also

Figure 2 – Global decommissioning costs reflected in the market capitalization of Oil Majors

which, taken as an aggregate, has decreased by

around 22% between 2014 and 2015.

IOCs Business refocus. International Oil com- Growing relevance of NOCs as spenders.

panies have not only reacted by cutting costs, but While Major IOCs, E&P companies and indepen-

also by refocusing their businesses on core activi- dents have sharply reduced investments, National

ties (being geographical areas or industry segments Oil Companies have been more resilient. Indeed,

such as refocusing on E&P while divesting from figure 3 shows that their upstream investments

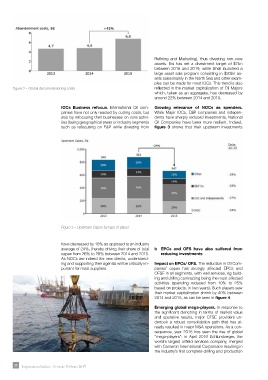

Figure 3 – Upstream Capex by type of player

have decreased by 18% as opposed to an industry

average of 24%, thereby driving their share of total b EPCs and OFS have also suffered from

capex from 26% to 28% between 2014 and 2015. reducing investments

As NOCs are indeed the new clients, understand-

ing and supporting their agenda will be critically im- Impact on EPCs/ OFS. The reduction in Oil Com-

portant for most suppliers. panies’ capex has strongly affected EPCs and

OFSE in all segments, with well services, rig build-

ing and drilling contracting being the most affected

activities (spending reduced from 10% to 25%

based on projects, in two years). Such players saw

their market capitalization shrink by 40% between

2014 and 2015, as can be seen in figure 4.

Emerging global mega-players. In response to

the significant clenching in terms of market value

and operative results, major OFSE providers un-

dertook a robust consolidation path that has al-

ready resulted in major M&A operations. As a con-

sequence, year 2016 has seen the rise of global

“mega-players”: in April 2016 Schlumberger, the

world’s largest oilfield services company, merged

with Cameron International Corporation resulting in

the industry’s first complete drilling and production

30 Impiantistica Italiana - Gennaio-Febbraio 2017