Page 35 - 51

P. 35

price sharp drop no longer allowed for such inef-

ficiencies.

Oil majors cut capex through project delay but also

through efficiency improvement solutions such as:

1. New approaches to exploration and devel-

Oil majors cut capex also through

efficiency improvement solutions

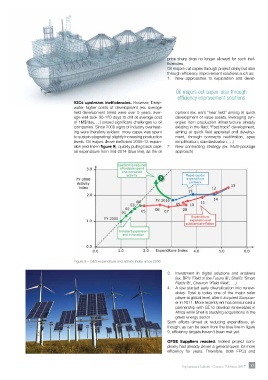

IOCs upstream inefficiencies. However, Deep-

water higher costs of development (ex. average

field development times were over 5 years, aver- opment (ex. eni’s “near field” aiming at quick

age well took 90-120 days to drill at average cost development of value assets, leveraging syn-

of 1M$/day, …) posed significant challenges to oil ergies from production infrastructure already

companies. Since 2008 signs of industry overheat- existing in the field; “Fast track” development,

ing were therefore evident: more capex was spent aiming at quick field appraisal and develop-

to sustain stagnating/ slightly increasing production ment, through concepts reutilization, spec

levels. Oil majors drove inefficient 2005-13 expan- simplification, standardization, …)

sion (red line in figure 9), quickly pulling back capi- 2. New contracting strategy (ex. Multi-package

tal expenditure from mid-2014 (blue line), as the oil approach)

Figure 9 – O&G expenditure and activity index since 2000

3. Investment in digital solutions and enablers

(ex. BP’s ‘Field of the Future ®’; Shell’s ‘Smart

Fields ®’, Chevron ‘iField iWell’, …)

4. A few started early diversification into renew-

ables: Total is today one of the major solar

player at global level, after it acquired Sunpow-

er in 2011. More recently eni has announced a

partnership with GE to develop renewables in

Africa while Shell is studying acquisitions in the

green energy sector

Such efforts aimed at reducing expenditure, al-

though, as can be seen from the blue line in figure

9, efficiency targets haven’t been met yet.

OFSE Suppliers reacted. Indeed project com-

plexity had already driven a general quest for more

efficiency for years. Therefore, both EPCs and

Impiantistica Italiana - Gennaio-Febbraio 2017 33