Page 55 - 74

P. 55

industry

applications and develop the capabilities to make than today.

the most of them. • Global demand for petrochemicals

manufactured from oil could grow between

Three scenarios for energy 25% and 30%, making it the most robust

sector across all three scenarios.

transition

Interestingly, over the past two decades, the 10-

Refi ners need a clear strategy to navigate the year forecasts for the growth of renewables came

energy transition, one that prepares them for in about 30% lower than what actually occurred—

market shifts caused by these changes. Bain’s suggesting that even the greenest forecasts may

recent research on integrated energy markets underestimate the potential for a lower-carbon

analyzed ways that several sources of disruption— sector.

including the geopolitics of the global oil supply, This has important implications for refi ners: In

competition from renewables and associated Bain’s Green Transformation scenario, demand

technologies, attitudes toward carbon policy, and declines so rapidly that even an acceleration in

changes in mobility—could infl uence total demand refi nery shutdowns will not prevent utilization rates

for oil and gas by 2030. Based on this research, we from falling to as low as 70% by the end of the next

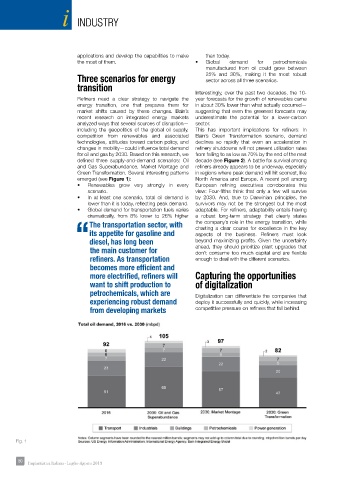

defi ned three supply-and-demand scenarios: Oil decade (see Figure 2). A battle for survival among

and Gas Superabundance, Market Montage and refi ners already appears to be underway, especially

Green Transformation. Several interesting patterns in regions where peak demand will hit soonest, like

emerged (see Figure 1): North America and Europe. A recent poll among

• Renewables grow very strongly in every European refi ning executives corroborates this

scenario. view: Four-fi fths think that only a few will survive

• In at least one scenario, total oil demand is by 2030. And, true to Darwinian principles, the

lower than it is today, refl ecting peak demand. survivors may not be the strongest but the most

• Global demand for transportation fuels varies adaptable. For refi ners, adaptability entails having

dramatically, from 8% lower to 26% higher a robust long-term strategy that clearly states

The transportation sector, with the company’s role in the energy transition, while

charting a clear course for excellence in the key

its appetite for gasoline and aspects of the business. Refi ners must look

“diesel, has long been beyond maximizing profi ts. Given the uncertainty

the main customer for ahead, they should prioritize plant upgrades that

don’t consume too much capital and are fl exible

refi ners. As transportation enough to deal with the different scenarios.

becomes more effi cient and

more electrifi ed, refi ners will Capturing the opportunities

want to shift production to of digitalization

petrochemicals, which are Digitalization can differentiate the companies that

experiencing robust demand deploy it successfully and quickly, while increasing

from developing markets competitive pressure on refi ners that fall behind.

Fig. 1

50 50 Impiantistica Italiana - Luglio-Agosto 2019