Page 34 - Impiantistica Italiana

P. 34

OPPORTUNITIES

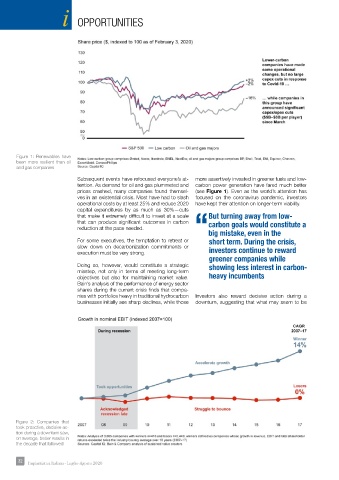

Figure 1: Renewables have

been more resilient than oil

and gas companies

Subsequent events have refocused everyone’s at- more assertively invested in greener fuels and low-

tention. As demand for oil and gas plummeted and carbon power generation have fared much better

prices crashed, many companies found themsel- (see Figure 1). Even as the world’s attention has

ves in an existential crisis. Most have had to slash focused on the coronavirus pandemic, investors

operational costs by at least 25% and reduce 2020 have kept their attention on longer-term viability.

capital expenditures by as much as 30%—cuts

that make it extremely difficult to invest at a scale But turning away from low-

that can produce significant outcomes in carbon carbon goals would constitute a

reduction at the pace needed.

“big mistake, even in the

For some executives, the temptation to retreat or short term. During the crisis,

slow down on decarbonization commitments or

execution must be very strong. investors continue to reward

greener companies while

Doing so, however, would constitute a strategic showing less interest in carbon-

misstep, not only in terms of meeting long-term

objectives but also for maintaining market value. heavy incumbents

Bain’s analysis of the performance of energy sector

shares during the current crisis finds that compa-

nies with portfolios heavy in traditional hydrocarbon Investors also reward decisive action during a

businesses initially see sharp declines, while those downturn, suggesting that what may seem to be

Figure 2: Companies that

took proactive, decisive ac-

tion during a downturn saw,

on average, better results in

the decade that followed

32 32 Impiantistica Italiana - Luglio-Agosto 2020