Page 49 - 38

P. 49

Price is one of the key factors that drive East North Africa) region resulted in an oversupply,

market dynamics in all the Industries forcing oil producing countries to fight for market

sectors, without exceptions. For the shares. In this context, the Opec, the leading super

oil & gas industry, low oil price isn’t power partially outshined by shale oil producers,

something new, but there are clear decided to defend its market share by keeping

evidences that a disruptive phase has its production stable at 30 million barrels per day

just begun. (a decision recently confirmed at the beginning of

In the last ten years oil price has been above 100 $/ June). It is not a “play for time” move, but actually

barrel without the industry feeling dizzy, rather giv- an aggressive decision, keeping prices well below

ing confidence to the IOC’s (International Oil Com- the operating break-even level of the new challen-

pany) to rush for the “frontier”, technological and gers, i.e. most unconventional sources such Ca-

geographical, with long term investments. It hap- nadian sands, shale oils and deep water. However,

pened twice, but in both cases believers of a high- countries with low production costs are not in the

oil-price steady future were cooled down (figure same shape and most likely not going to win all

1). The two falls (two “black swans” for metaphor together. Indeed, current prices are also lower than

lovers) in 2008/2009 and 2014/2015 have though fiscal national budgets for most of them, while only

different grounds and roots. In 2008 the financial few have cash reserves to sustain the game for

fever, later classified as crisis, infected the “brick long and defend the market share.

and mortar” economy, spreading across all the

industries, ultimately resulting in a sudden reduc- Challenges of a new era

tion of oil price. Since then and until the second

half of 2014, the oil price recovered, being steadily What’s next? Market consensus is aligned on a

above 100 $/barrel and, even if the world economy scenario with oil price in a band between 65 and

still coughs, the recent drop in oil price cannot be 85 $/barrel for future years and different paths for

explained as an indirect consequence of financial recovery. Ironically, in the last ten years the oil price

games. Indeed, the drop finds its roots in the oil was mostly out of this band; however, it is more re-

“fundamentals”, being the dynamics of supply and levant to notice that the oil & gas industry has star-

demand, coupled with geopolitics. ted reshaping itself to “fit for 60”, likely the dawn of

a new era.

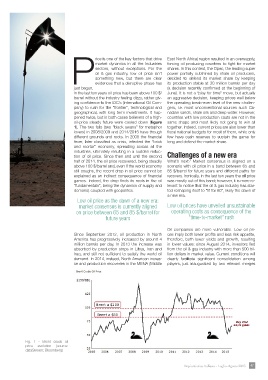

Low oil price as the dawn of a new era:

market consensus is currently aligned Low oil prices have unveiled unsustainable

on price between 65 and 85 $/barrel for operating costs as consequence of the

“time-to-market” rush

future years

Since September 2012, oil production in North Oil companies are more vulnerable. Low oil pri-

America has progressively increased by around 4 ces imply both lower profits and less risk appetite,

million barrels per day. In 2013 the increase was therefore, both lower yields and growth, resulting

absorbed by production stops in Libya, Iran and in lower values: since August 2014, investors fled

Iraq, and still not sufficient to satisfy the world oil from the oil & gas industry with more than 500 bil-

demand. In 2014, instead, North American increa- lion dollars in market value. Current conditions will

se and production recoveries in the MENA (Middle clearly facilitate significant consolidation among

players, just inaugurated by two relevant merges

Fig. 1 - Brent crude oil

price evolution (source:

dataStream; Bloomberg)

Impiantistica Italiana - Luglio-Agosto 2015 47