Page 22 - impiantistica_5_15

P. 22

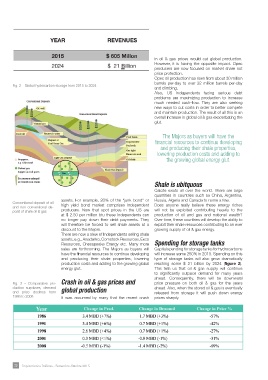

Fig. 2 – Global hydrocarbon storage from 2015 to 2024 in oil & gas prices would cut global production.

However, it is having the opposite impact. Opec

producers are now focused on market share not

price protection.

Opec oil production has risen from about 30 million

barrels per-day to over 32 million barrels per-day

and climbing.

Also, US Independents facing serious debt

problems are maximizing production to increase

much needed cash-flow. They are also seeking

new ways to cut costs in order to better compete

and maintain production. The result of all this is an

overall increase in global oil & gas exacerbating the

glut.

The Majors as buyers will have the

financial resources to continue developing

and producing their shale properties,

lowering production costs and adding to

the growing global energy glut.

Conventional deposit of oil assets. For example, 20% of the “junk bond” or Shale is ubitquous

and non conventional de- high yield bond market comprises Independent

posit of shale oil & gas producers. Now that spot prices in the US are Calcite exists all over the world. There are large

at $ 2.50 per million btu these Independents can quantities in countries such as China, Argentina,

Fig. 3 – Comparative pro- no longer pay down their debt payments. They Russia, Algeria and Canada to name a few.

duction surpluses, demand will therefore be forced to sell shale assets at a Does anyone really believe these energy riches

and price declines from discount to the Majors. will not be exploited contributing heavily to the

1986 to 2008 There are now a slew of Independents selling shale production of oil and gas and national wealth?

assets, e.g., Anadarko, Comstock Resources, Exco Over time, these countries will develop the ability to

Resources, Chesapeake Energy etc. Many more exploit their shale resources contributing to an ever

sales are forthcoming. The Majors as buyers will growing supply of oil & gas energy.

have the financial resources to continue developing

and producing their shale properties, lowering Spending for storage tanks

production costs and adding to the growing global

energy glut. Capital spending for storage tanks for hydrocarbons

will increase some 250% in 2015. Spending on this

Crash in oil & gas prices and type of storage tanks will also grow dramatically

global production reaching some $ 21 billion by 2024 (figure 2).

This tells us that oil & gas supply will continue

It was assumed by many that the recent crash to significantly outpace demand for many years

ahead. Consequently, there will be downward

price pressure on both oil & gas for the years

ahead. Also, when the stored oil & gas is eventually

released from storage it will push down energy

prices sharply.

20 Impiantistica Italiana - Settembre-Ottobre 2015